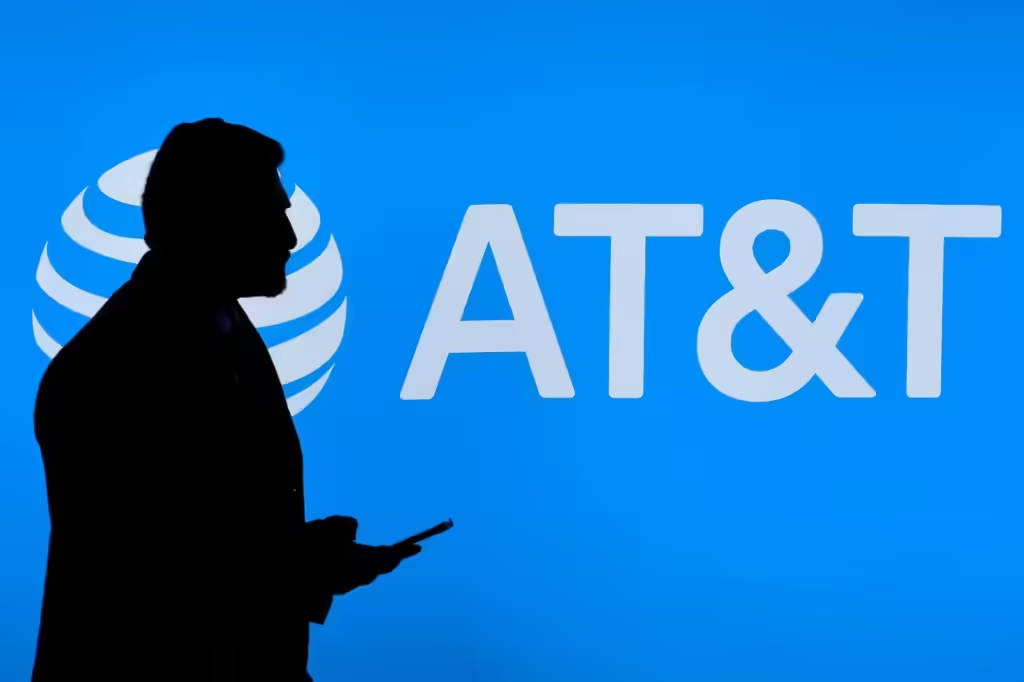

AT&T Inc. (NYSE: T), one of the largest telecommunications companies globally, has been making headlines recently with significant updates that are influencing its stock performance and broader market outlook. In today’s news, the company declared its latest dividend, sold off its remaining stake in DirecTV, and continues to focus on its growth strategy in 5G and fiber broadband.

AT&T Declares Dividend for November 2024

On September 27, 2024, AT&T’s board of directors announced a quarterly dividend of $0.2775 per share on the company’s common shares, which will be paid out on November 1, 2024. This announcement remains consistent with the company’s focus on returning value to shareholders, despite the challenging macroeconomic environment in the telecom sector. The dividend payout is available to shareholders of record as of October 10, 2024(

markets.businessinsider.com)(

This announcement reflects the company’s ongoing commitment to maintaining a steady dividend, which is an attractive feature for income-focused investors, especially those drawn to AT&T’s historically high dividend yields.

AT&T Sells Remaining Stake in DirecTV

In other major news, AT&T has finalized a deal to sell its remaining 70% stake in DirecTV to TPG for $7.6 billion. This move comes after years of declining performance from the satellite television service, which has struggled amid the rise of streaming platforms like Netflix and Disney+. The sale clears the way for DirecTV to pursue potential mergers, most notably with Dish Network, a longtime competitor in the pay-TV space(

markets.businessinsider.com)(

This strategic decision is part of AT&T’s ongoing focus to streamline its operations and concentrate more on its core business areas—5G wireless services and fiber broadband. By shedding non-core assets like DirecTV, AT&T aims to strengthen its balance sheet and free up resources to invest in more promising growth areas.

What This Means for AT&T Investors

These announcements are likely to be welcomed by AT&T investors, who have been watching closely for signs that the company is successfully managing its debt load and refocusing on its core strengths. The sale of DirecTV, in particular, allows AT&T to reduce its exposure to the struggling satellite TV sector and focus more on its 5G and fiber optic broadband initiatives, both of which are seeing growing demand across the U.S.(

Additionally, the reaffirmation of a stable dividend is another positive indicator, especially for income-focused investors. The payout offers a solid yield in an uncertain economic climate, and it continues to be a significant reason why many investors remain loyal to AT&T despite the stock’s fluctuating price over the years.

Growth Opportunities: Fiber and 5G Expansion

Despite selling off assets like DirecTV, AT&T is aggressively pushing ahead with its expansion in high-growth sectors like 5G and fiber optics. The company has reported positive subscriber growth in these areas, driven by consumer demand for faster and more reliable internet connections. This is especially true in the residential and business segments, where AT&T’s multi-gig fiber services have gained significant traction.

The rollout of 5G services also offers AT&T a lucrative growth path. The company’s management has highlighted that they expect substantial revenue increases as more customers upgrade to 5G plans, and as new business applications for 5G technology, such as IoT (Internet of Things), come online(

markets.businessinsider.com)(

Stock Performance: A Rebound Year?

AT&T’s stock has seen some positive movement in 2024, rebounding from its lows in previous years. The company’s strategic refocus on core areas, coupled with cost-cutting measures and a more disciplined financial approach, has led to improved investor sentiment. AT&T shares are up around 28% year-to-date, outperforming the broader market and marking its best performance in recent years(

The market has responded well to AT&T’s efforts to strengthen its core business and maintain its dividend payout, leading to upgrades from various analysts. As of now, AT&T is considered a more attractive option for long-term investors seeking income stability and potential capital appreciation as the company continues to restructure and grow its business(

What’s Next for AT&T?

Looking forward, AT&T’s future will be shaped by its success in scaling its fiber network and 5G infrastructure, as well as by how effectively it can manage its remaining debt. The company’s ability to generate free cash flow and maintain its dividend while investing in these growth areas will be critical for long-term success.

Investors should keep a close eye on AT&T’s quarterly earnings reports, as well as any additional asset sales or restructuring efforts aimed at improving profitability. Furthermore, potential mergers in the satellite TV market, particularly involving Dish Network and DirecTV, could have broader implications for AT&T as well, given its historical ties to DirecTV(

Leave a Reply