Introduction

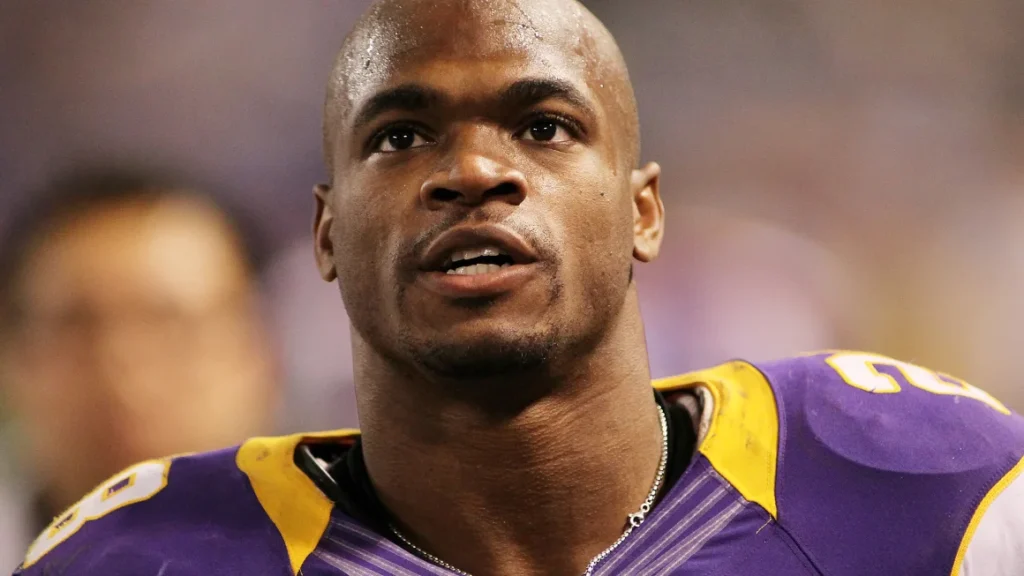

Former NFL star Adrian Peterson, renowned for his stellar football career, faces a new challenge: legal and financial turmoil. Recent reports reveal that a Houston judge has ordered the ex-Minnesota Vikings running back to surrender personal assets to address more than $12 million in debts. Despite earning over $100 million during his 14-year NFL career, Peterson’s financial mismanagement and escalating debts highlight the risks of unsustainable spending and bad loans.

Debt and Legal Orders: What Happened?

Adrian Peterson’s financial difficulties came to light when a Texas judge mandated him to turn over assets to help repay his outstanding debt. The trouble reportedly began with a $5.2 million loan Peterson took from a Pennsylvania lender in 2016. However, with soaring interest rates and legal fees, the loan has grown to a staggering $12.5 million, leading to aggressive repayment measures.

NFL commentator Shannon Sharpe, reacting to the news, expressed disbelief that a player with Peterson’s earnings could end up in such a situation, pointing out the challenges athletes face managing wealth responsibly. The lavish lifestyle Peterson maintained, including extravagant celebrations like his 30th birthday party featuring exotic animals, may have accelerated his financial downfall.

Lessons From Peterson’s Financial Struggles

- Lifestyle Inflation and Overspending Risks

Even high earners can find themselves in financial trouble if they fail to manage spending effectively. Peterson’s case reflects how income alone isn’t a safeguard against debt, especially if spending habits don’t align with long-term planning. - The Danger of High-Interest Loans

His $5.2 million loan spiraling into $12.5 million is a reminder of how loans with high-interest rates can snowball into overwhelming burdens. This issue resonates beyond celebrities, as many Americans face similar debt escalation through credit cards or personal loans.

NFL Players and Financial Challenges

Peterson’s case underscores a broader trend of financial distress among professional athletes, despite earning millions. Studies show that lifestyle inflation, poor investments, and lack of financial literacy contribute significantly to such issues.

Peterson is not the first NFL player to encounter financial hardship post-retirement, and without proper intervention, it’s unlikely he’ll be the last. Sharpe’s commentary about Peterson—citing both lavish spending and the pressures of a wealthy lifestyle—highlights the importance of financial education for athletes at the peak of their careers.

Adrian Peterson’s Legacy and Next Steps

Despite his financial issues, Adrian Peterson’s football legacy remains unshaken. With over 14,000 rushing yards and several NFL accolades, he’s considered one of the best running backs in the history of the sport. Now, Peterson’s focus will likely shift towards resolving his financial woes, possibly through asset liquidation or legal negotiations.

Meanwhile, his story serves as a cautionary tale for current and retired athletes, emphasizing the importance of planning for life beyond sports.

How to Stay Updated on the Latest Sports News

To stay informed about Adrian Peterson and similar NFL updates, visit Newsify for the latest developments, trends, and sports analyses.

External Resources for Financial Literacy and Debt Management

- NFL Financial Education Programs: Designed to support athletes in managing wealth.

- LendingTree: For those seeking advice on high-interest loan management.

- Federal Reserve: Offers insights on consumer credit trends and interest rates.

Leave a Reply